Stop wasting dev time: PM's Guide to Preliminary Research on Third-Party Integrations

Apr 03, 2025

As a product manager, you’re constantly making decisions about what features your product needs and how to build them.

But before development really starts, there’s one critical question you should always ask: Do we really need to build this ourselves?

In many cases, a third-party solution can do the job faster, cheaper, and more reliably than an in-house build. Payment processing, authentication, data analytics are examples of really complex systems that many companies spend months or even years developing from scratch, only to realize later that an existing solution could have saved them significant time and resources.

Relying on a third-party integration is also about reducing risk and ensuring long-term maintainability. When done right, integrating with a third-party provider can help your product scale faster while allowing your engineering team time to focus on building what truly differentiates your product.

So how do you evaluate third-party solutions effectively?

In this guide, we’ll walk through a step-by-step framework to help you research, assess, and confidently choose the right integrations for your product..without getting lost in technical jargon.

What is a third-party integration?

Before diving into how to research third-party integrations, it’s important to understand what an integration actually is in the context of product development.

A product integration is when two or more software products are connected to work together seamlessly. These integrations allow different tools, systems, or services to exchange data, automate processes, and improve functionality without requiring users to switch between platforms.

Here’s an example: A customer support platform integrating with a CRM so that support agents can view customer data without leaving their dashboard.

A popularly talked about type of product integration is a third-party integration.This specific type of product integration connects your product to an external service or tool built by another company. Instead of developing a feature in-house, you integrate with a third-party provider to leverage their technology.

An example would be Instead of building its own payment processing system, you integrate with Stripe or PayPal to handle transactions securely.

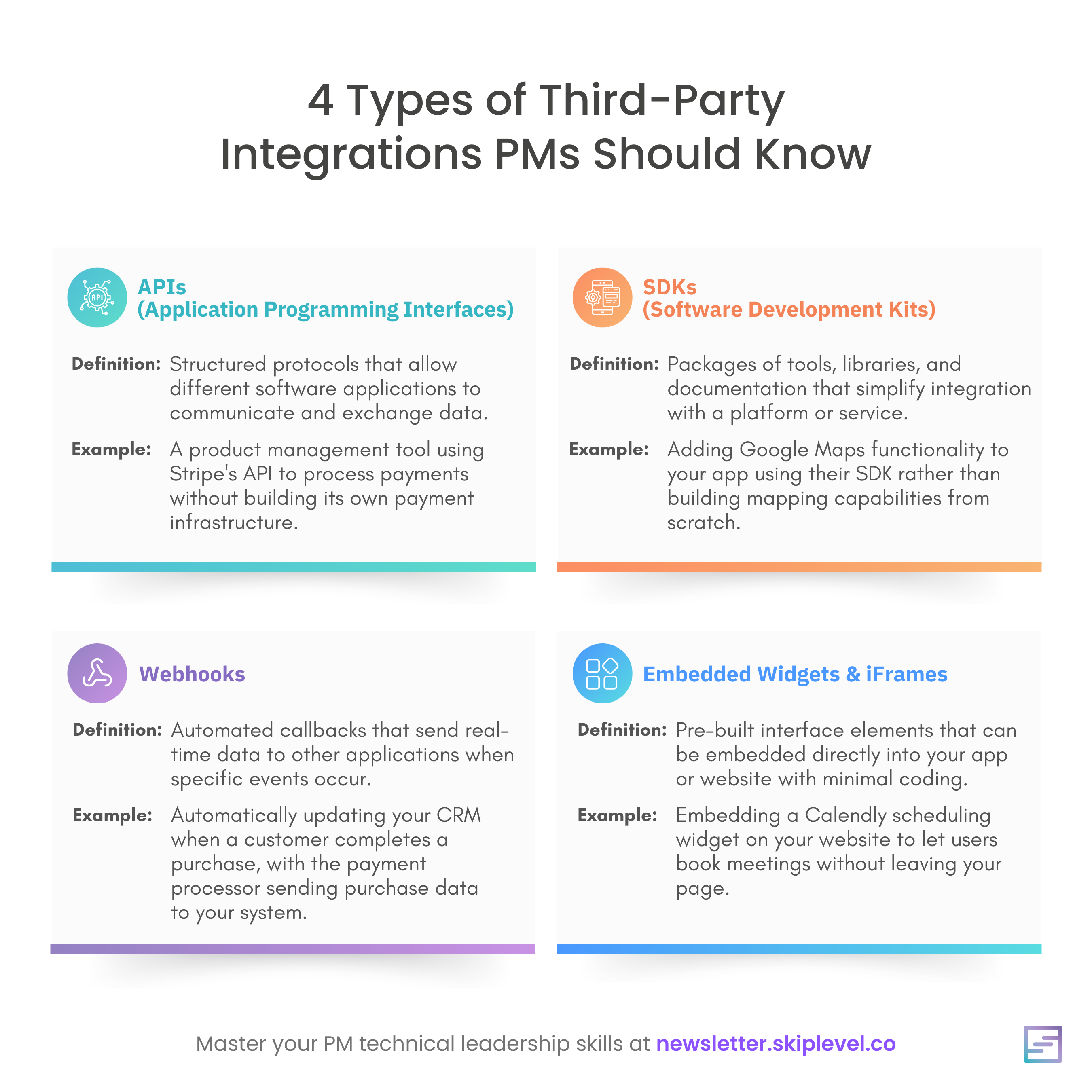

There are several ways that third-party integrations connect different products and services:

-

APIs (Application Programming Interfaces): The most common way integrations happen. Example: A travel booking site uses the Google Maps API to display hotel locations.

-

SDKs (Software Development Kits): Pre-packaged code libraries that help developers integrate a third-party service into an app more easily. Example: A mobile app uses the Facebook Login SDK to allow users to sign in with their Facebook accounts.

-

Webhooks: Event-driven notifications that allow real-time updates between services. Example: An e-commerce platform sends a webhook to an inventory system whenever a new order is placed.

-

Embedded Widgets & iFrames: Pre-built UI components that allow third-party functionality within a product without deep integration. Example: A SaaS platform embeds a Stripe checkout widget instead of building its own payment form.

Step-by-Step PM’s Guide to Researching Third-Party Integrations

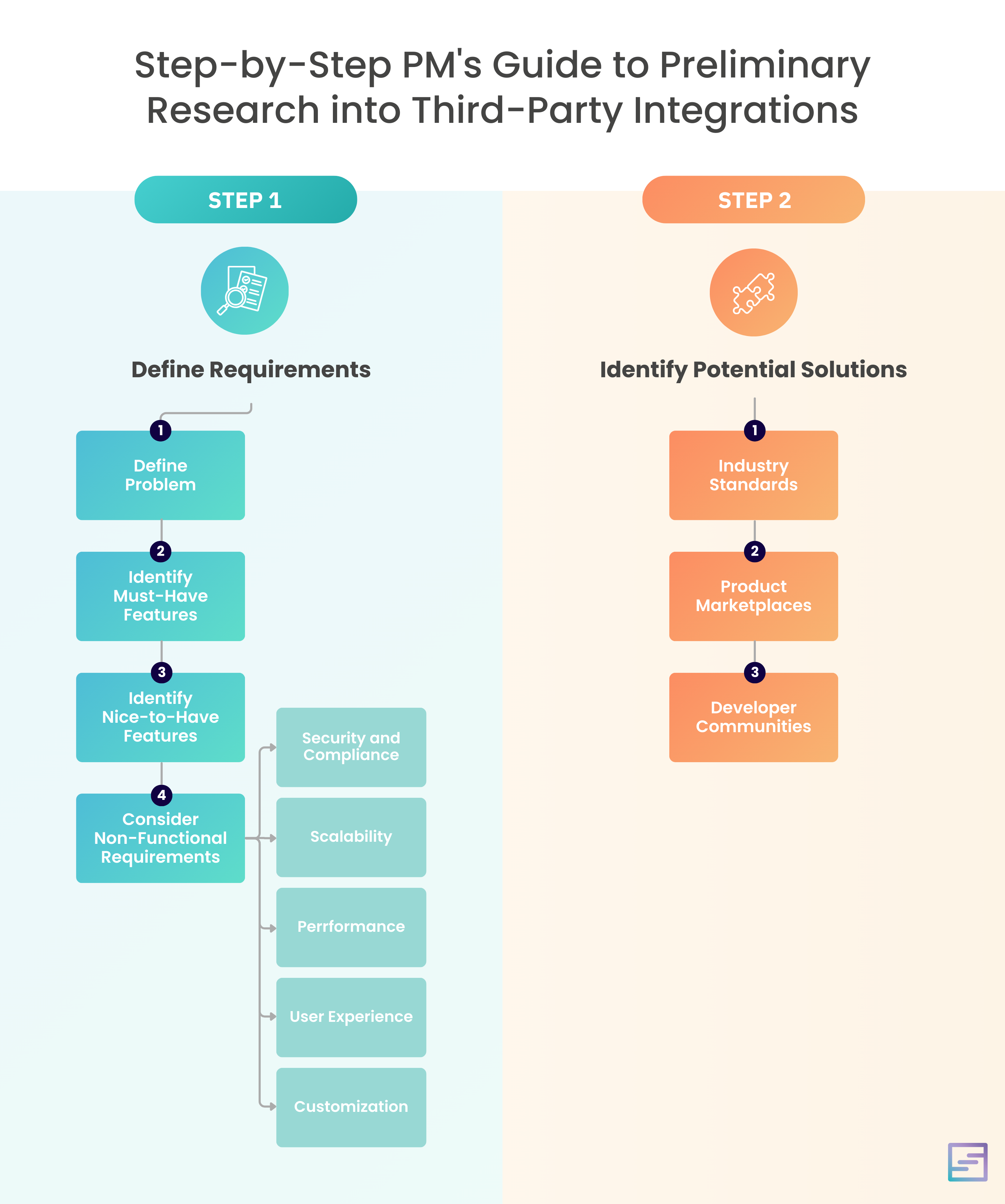

Step 1: Define Your Requirements

Before researching third-party integrations, the first and most important step is to clearly define what you need. Without a solid understanding of your product’s requirements, you risk choosing a solution that doesn’t fully meet your needs.. or worse, investing time and resources into integrating a tool only to realize it won’t work as expected.

To define your requirements, start by asking these key questions:

1. What problem are you solving?

What functionality do you need that your product doesn’t currently provide? Is this integration solving a core problem for your users, or is it supporting an internal process?

For example: An online marketplace wants to enable sellers to accept payments. Instead of building a payment system from scratch, they consider integrating with a third-party provider like Stripe or PayPal.

2. What are your must-have vs. nice-to-have features?

Not all integrations offer the same capabilities. Outline the critical features versus those that would be good to have but aren’t deal-breakers. Here are the 2 main question ou want to ask yourself:

-

What are the essential capabilities that directly impact product functionality? These are must-haves and should be prioritized as part of P0.

-

What are features that improve user experience but aren’t critical? These are “Nice-to-haves” and you can prioritize them after P0 requirements.

For example, imagine you need a payment system for your product. Your must-have (P0) might be ability to process credit card payments, and compliance with PCI-DSS security standard. Your Nice-to-haves (P1, etc.) might be support for alternative payment methods like Apple Pay or cryptocurrency.

3. What non-functional requirements should you consider?

Beyond features, there are several other factors to evaluate:

-

Security & Compliance: Does the solution meet necessary legal and security standards (e.g., GDPR, PCI-DSS for payments, SOC 2 for SaaS tools)?

-

Scalability: Can it handle increasing usage as your product grows?

-

Performance: Will the integration impact speed or reliability?

-

User Experience: Will it provide a seamless, intuitive experience for users?

-

Customization: Does it allow flexibility to meet your specific needs?

Step 2: Identify Potential Solutions

Once you’ve defined your requirements, the next step is to find and evaluate potential third-party solutions. There are thousands of third-party providers out there, so knowing where to look and what to prioritize will save you time and help you focus on the most viable options.

Here are 3 places I suggest looking into for existing third-party integration options:

-

Start with the industry standards: What solutions are your competitors or similar companies using? If most fintech products rely on Stripe or Adyen for payments, there’s probably a reason. A quick look at competitor websites, case studies, or integration pages can give you a solid starting point.

-

Check product marketplaces and directories. Platforms like AWS Marketplace, RapidAPI, or Zapier offer pre-vetted solutions with customer reviews and feature breakdowns. These can help you find integrations that align with your tech stack and requirements.

-

Beyond that look at developer communities: I would start with people you already know. PMs and engineers who’ve implemented similar integrations can usually share their firsthand experience. Then check Stack Overflow, GitHub, and Reddit are goldmines for real-world insights. A sleek marketing page might make an API look great, but forums will tell you if the documentation is a nightmare or if hidden fees make it less attractive.

At this point, your goal isn’t to choose the best solution just yet. Instead, narrow your list to a few strong contenders that meet your must-have criteria.

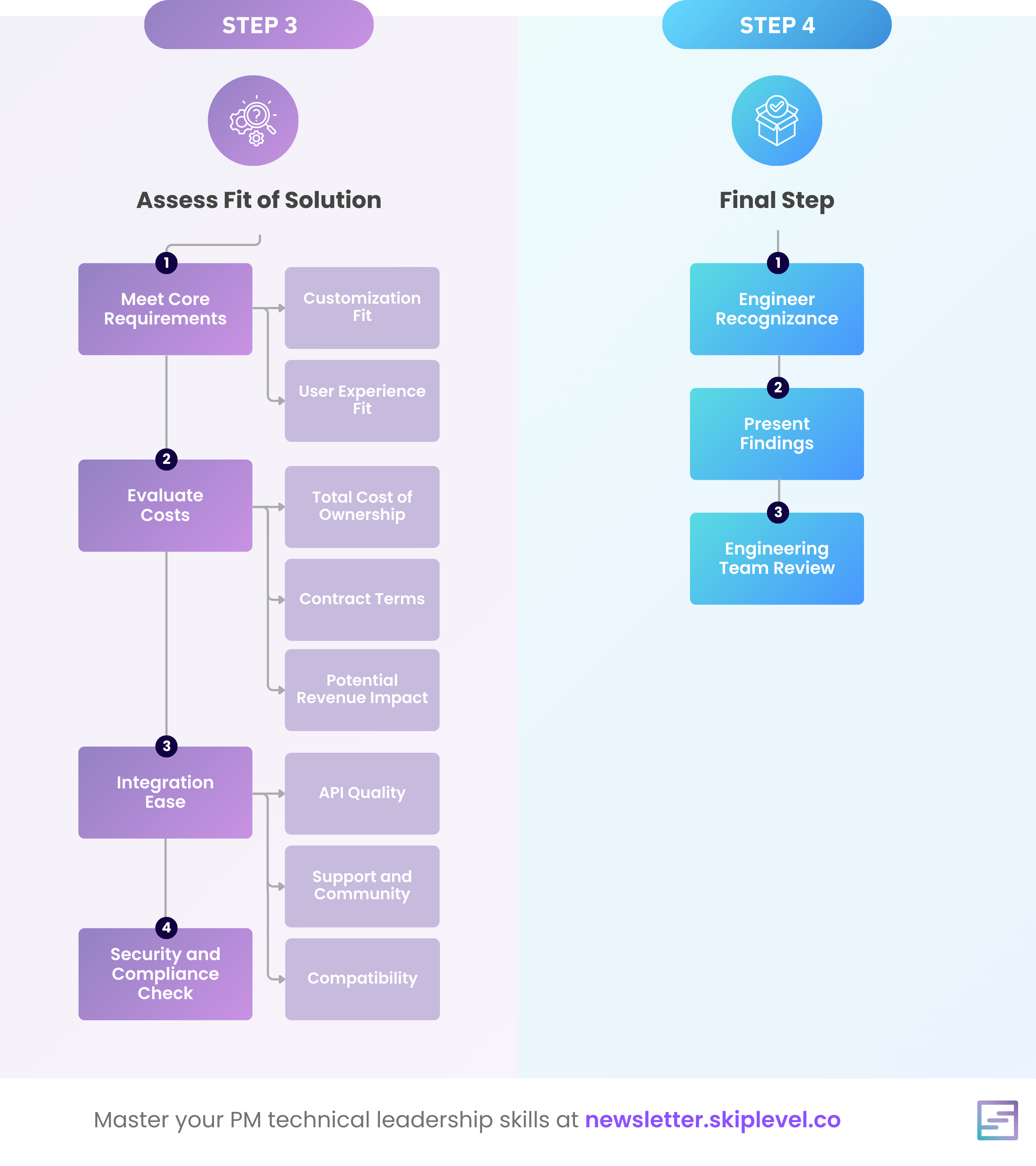

Step 3: Assessing the Fit

Now that you have a shortlist of potential third-party solutions, the next step is to figure out which one best fits your product’s needs that goes beyond requirements and features to take into consideration marketing, sales, and technical considerations.

Evaluating your list of potential third-party solutions can get a little complicated due to the number of considerations and the technical complexity of evaluating a third-party integration, especially if you’re a non-technical product manager.

Here’s how to evaluate your options:

1. Does It Meet Your Core Requirements?

Go back to the must-have features you defined earlier. If a solution doesn’t check all your non-negotiables, it’s an easy elimination. Beyond that, you have to consider two very important things:

-

Customization: Can it adapt to your specific use case?

-

User experience: Will it provide a seamless experience for customers?

If the third-party company offers a live demo, I highly suggest scheduling one as it will 100% decrease the amount of time you spend researching and also reveal unknown unknowns that could swing your decision either way. I would be prepared going into the demo so you know what questions you want to ask so definitely still do some recognizant research via their documentation.

2. What Are the Costs (Beyond Pricing)?

Pricing models can be tricky. Some providers charge per transaction, some have monthly fees, and others have hidden costs (like extra charges for premium features or customer support). When thinking about costs, you want to consider:

-

Total cost of ownership: Are there setup, maintenance, or scaling costs?

-

Contract terms: Are you locked into a long-term agreement?

-

Potential revenue impact: Does the provider take a percentage of each transaction?

3. How Easy Is It to Integrate?

Not all integrations are created equal. A powerful API is great, but if the documentation is poor or the setup is overly complex, the engineering team will face a frustrating and time-consuming process. So once you get deeper into the technical weeds researching third-party integrations, you’ll want to keep in mind the following:

-

API quality: Is the documentation clear? Are there SDKs available?

-

Support & community: Is there a strong developer community or customer support?

-

Compatibility: Does it work with your existing tech stack?

4. Is It Secure and Compliant?

Security and compliance are critical, especially in regulated industries like fintech. Make sure the provider meets necessary security standards (e.g., PCI-DSS for payments, GDPR for data privacy) and has strong fraud protection measures in place. Some engineers may already have experience with security and compliance measures but generally they will look to you for guidelines on legal security and compliance so be prepared to answer questions and set requirements.

Step 4: Get final input from an engineer

Ultimately an engineer on the project will need to do final recognizance on the third-party integration option since they’ll be responsible for implementing and maintaining the integration.

But doing the preliminary research on third-party integration options goes a long way to building trust with the engineering team. Once you’ve completed preliminary research, present what you’ve found to the engineering team along with your top suggestion for third-party integration, and WHY. The engineering team at that point will do a deeper tech dive into dev documentation to make sure the integration will work with the existing stack while pointing out any red flags and potential short- and long-term risks of the integration.

Become more technical without learning to code with the Skiplevel program.

The Skiplevel program is specially designed for the non-engineering professional to give you the strong technical foundation you need to feel more confident in your technical abilities in your day-to-day role and during interviews.